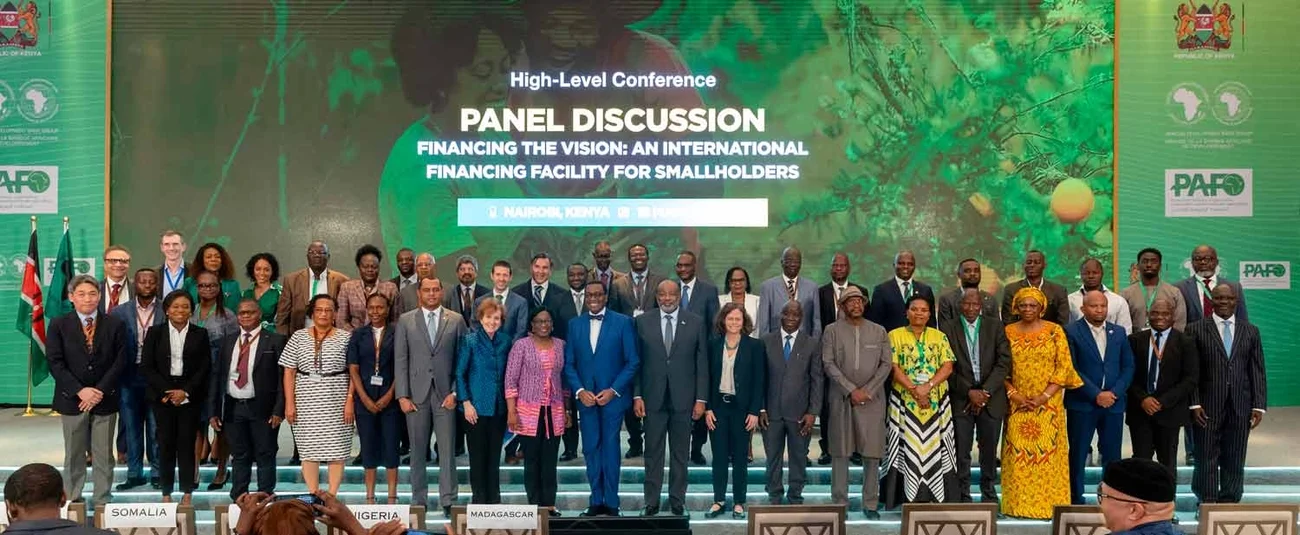

Landmark Conference in Nairobi Mobilizes Commitment to Unlock $10 Billion for Africa’s Farmers

Nairobi, Kenya | March 17–18, 2025

The Pan-African Farmers’ Organization (PAFO) and the African Development Bank (AfDB) joined forces in a historic effort to transform African agriculture through innovative financing solutions. During the Scaling Finance for Smallholder Farmers in Africa Conference, held in Nairobi, Kenya, stakeholders unveiled bold commitments to bridge the longstanding financing gap affecting smallholder farmers across the continent.

At the heart of the conference was the announcement of a planned $500 million facility, expected to unlock up to $10 billion in financing for Africa’s smallholder farmers and agribusinesses. This initiative marks a turning point in the push to empower the farmers who produce over 70% of the continent’s food yet remain largely excluded from formal financial systems.

Addressing the $75 Billion Financing Gap

Throughout the two-day event, experts and policymakers emphasized the urgent need to address the $75 billion annual financing shortfall that continues to hinder agricultural productivity, rural incomes, and food security.

AfDB President Dr. Akinwumi Adesina called for a fundamental shift: “Agriculture contributes over 30% to Africa’s GDP, yet only 6% of commercial bank lending goes to the sector. That must change.”

A Platform for Farmer-Centered Solutions

Organized by PAFO, in collaboration with AfDB and the Government of Kenya, the conference gathered farmer leaders, regional organizations (EAFF, ROPPA, PROPAC, SACAU), development partners, financial institutions, and government ministers from across Africa.

Speaking at the opening, PAFO President Ibrahima Coulibaly stressed the importance of empowering farmers not just as beneficiaries, but as active participants:

“We’re not asking for charity—we’re asking for strategic investment. Smallholders are the backbone of our economies, and we are ready to deliver results when supported.”

Key discussions focused on:

• De-risking agricultural finance through blended instruments

• Digitalization of agriculture to improve access and efficiency

• Building capacity on the demand side, helping farmers prepare bankable proposals

• Public-private partnerships that prioritize rural communities and food sovereignty

Elevating Youth and Women in Finance

With a strong presence of youth and women, the conference spotlighted the role of inclusive finance. Testimonies from women-led cooperatives and youth entrepreneurs revealed both the challenges they face and the opportunities that targeted investment could unlock.

High-Level Political Engagement

In a powerful unscheduled moment, PAFO leaders—including President Coulibaly, CEO Dr. Babafemi Oyewole, and representatives from EAFF, PROPAC, and SACAU—held an impromptu meeting with H.E. Mr. Moses Vilakati, the newly appointed AU Commissioner for Agriculture, Rural Development, Blue Economy and Sustainable Environment.

Commissioner Vilakati expressed deep commitment to collaborating with farmer organizations:

“PAFO must walk with us and challenge us. Don’t hesitate to remind me of what matters most—because when farmers rise, Africa rises.”

What Comes Next

The Nairobi conference concluded with a collective commitment: to move beyond declarations and into delivery. PAFO and the African Development Bank in line with the action plan developed to implement the MoU Between the two institutions will continue to work toward ensuring that the financing facility is put in place to scale up financing for smallholder farmers and place them at the center of Africa’s agricultural development. As Dr. Babafemi Oyewole noted in his closing statement for the first day: “We know what works. Now is the time to scale it.”